Industry averages are important benchmarks used to help your small business make comparisons of key metrics to other businesses in your vertical. If you don’t understand industry averages for your business, it’s time to get educated on the numbers. An understanding of the topic can be game-changing, partly because one of the biggest mistakes small businesses make is chasing the wrong numbers.

They seek to rank for keywords that won’t generate quality leads. They focus on the volume of content produced as opposed to producing high quality content at a tolerable pace. And just as often, they court business from customers who are likely to never convert, much less become a long-term customer. I see this frequently with businesses of all sizes.

How I learned to appreciate industry averages

Chasing meaningless metrics takes your focus away from the areas of the business most likely to help the bottom line, a lesson I learned more than a decade ago when I created an email newsletter for a segment of the sporting goods industry. In addition to managing a website and compiling the information for the newsletter, I poured over the performance data weekly, paying close attention to click-through rates, click-to-open rates, and new signups.

Of the 2,300 emails I was sending to readers each month, only 44% were being opened, and fewer than 10% were clicking any of the links on the page. Depressed and crestfallen, I sought out industry data on open rates for my sector. The number was around five percent. You read that correctly; I was over-performing the industry average by 880%. Upon this realization, I had two thoughts:

- I could have wasted months trying to increase my open rates if not for this data.

- My time was best spent increasing retention (i.e., preventing unsubscribes) and upsells (e.g., purchases of my e-books).

Over the next few months, I focused on creating landing pages for the e-books and driving greater engagement through the use of better subject lines. By year’s end, the rates for new subscribers, open, and e-book sales increased dramatically from the previous six months.

The importance of industry-specific data

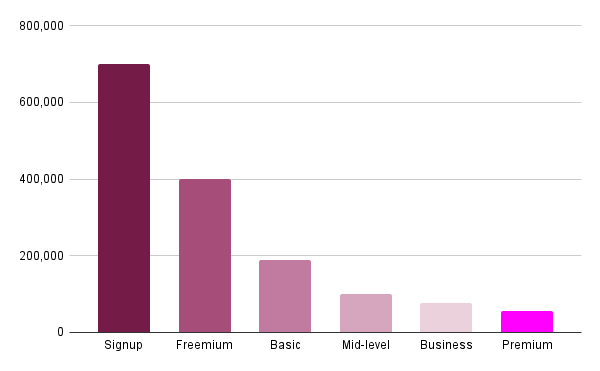

This all came to be because I availed myself of data on industry averages. Now, years later, I make sure all of my clients understand industry averages, which prevents us from chasing metrics that have little long-term value. For example, with a recent technology client, my task was to help them solve a problem that had flummoxed management for years: How to nudge the folks who sign up for freemium accounts to become paying customers.

After three months of digging through data, I discovered that they had been looking at the problem wrong for years: The number of customers who converted to a paid plan was at or above the industry average. Their real goal should be to acquire more revenue from paying customers. We approached this effort strategically. But instead of focusing on increasing the numbers among all paying customers, a little deep diving made it clear where our focus should be placed: on those clients least likely to churn.

So, instead of focusing on customers on the basic plan—which had the largest numbers of paying customers—or the mid-level plan, which was generating the highest revenue, we focused our attention on the customers on the premium plan, as they had the highest long-term value for the business. (That is, they were most likely to renew and they remained customers for years.)

How we reached such conclusions was quite easy:

- We were privy to category-specific data on industry averages, and

- We were laser-focused on the goals of the business (i.e, retaining customers having the highest lifetime value).

Your small business can avail itself to data on industry averages, which is readily available for all sectors, whether from organizations, experts or government entities.

How to get industry averages data for your business

One of the best places to get accurate industry averages data for your small business is from your local chamber of commerce. While much of the data they track may be of the generic variety, as in the business climate overall, they often track businesses by verticals as well. Assuming their membership is robust and representative of the overall market you serve, they should be able to provide details such as average sales per square foot, hiring and retention metrics, rent pricing, etc.

For more specific data, you can do a keyword search of Google or popular social media apps such as Facebook, Twitter or Instagram to find experts’ blogs, industry guides and whitepapers, and long-term studies, which can be invaluable for year-over-year and historical analysis.

Make acquiring industry average metrics a priority.

You owe it to yourself to understand industry averages, in large part because they can help prevent you from implementing a bad strategy and chasing the wrong goals.